Introduction to Startup Funding

You have an idea for an amazing business startup. You know it will make millions, make the world a better place, let you fulfil your dreams, help others succeed (or even all of these things together). There’s just one problem – you don’t have the money to fulfil the promise of your new business. You need startup funding!

As an entrepreneur, being able to secure adequate capital is often the key to transforming your innovative ideas into a thriving business. However, whether you’re a first-time or experienced entrepreneur and business owner, navigating the landscape of startup funding can be a challenging task.

Much of the information on the internet has been written by lenders, and it is – of course – focused on their own products and services. There’s nothing wrong with this. But as a small business owner, you need somewhere you can find unbiased information.

That’s why we’ve created this Ultimate Guide – to give you a balanced roadmap that helps you understand the process you’ll need to follow in order to securing funding for your startup.

This Ultimate Guide contains general information and should not be relied upon as advice. We are not financial advisers. Unless you are a client of Blaze Business & Legal, we do not know enough about your specific circumstances to be able to give you business and/or legal advice. Please feel free to contact us if you’d like to discuss anything in this Ultimate Guide or about your startup.

In this Ultimate Guide, we discuss the critical role that startup funding plays in the success and growth of your business venture. We explore various funding options, from bootstrapping (and what this means) to taking a startup loan, to seeking grant funding or angel investors. And we give you some scenarios you can use to draw parallels with the circumstances in your own startup business.

Our aim is to equip you with actionable insights so you can make informed decisions at every stage of your entrepreneurial journey. So let’s get cracking!

Empowering Entrepreneurs in Their Funding Journey

It’s critical for entrepreneurs to have access to real-world, unbiased, and practical guidance. This Ultimate Guide is designed to empower you with actionable steps and valuable information, enabling you to take control of your startup funding strategy with confidence.

If you need Business Advisory or Legal Services for an Australian business, reach out and book a free Strategy Session with us. Otherwise, we hope this Ultimate Guide helps you take a giant leap forward in your business journey.

PS: With your focus on securing funding for your startup, don’t forget you need to put your startup legals in place!

PPS: Prefer to read this awesome content in a book format? Pop your email address on our waitlist and we’ll notify you when our book is ready.

Ultimate Guide Structure and Chapter Overview

Chapter 1: The Startup Funding Landscape

In the first chapter of our Ultimate Guide:

- We discuss the significance of early-stage funding and its importance for startups.

- We explore the impact of adequate capital on business growth.

- We help you understand the funding landscape and the common challenges faced by startups.

- We give you a real-world scenario to illustrate funding successes and failures.

A point to note: We know that many international entrepreneurs will read this Ultimate Guide. While much of the information in this Guide is general in application (and will apply internationally), please keep in mind that we are located in Australia. You will need to consider your own country or state-specific rules and requirements.

Some entrepreneurs are able to startup their business without seeking funding from external sources. This is often called “bootstrapping” or “private investment” (where an entrepreneur/ Director/Shareholder loans money to their own business).

A well-crafted Business Plan serves both as a roadmap for your startup and as a powerful tool to attract investors and stakeholders. Make sure it presents a compelling case for your business’s success and showcases your commitment to thorough planning and execution.

Chapter 2: Crafting a Winning Business Plan

In the second chapter of our Ultimate Guide, we:

- Emphasise the importance of a well-structured Business Plan as the foundation for securing funding.

- Highlight the key components of a Business Plan and offer actionable tips for effective planning.

- Provide step-by-step guidance on creating a compelling Business Plan, including market analysis, competitive research, and financial projections.

- Give you a real-world scenario to illustrate how your Business Plan will be used by investors or lenders.

Chapter 3: Exploring Startup Funding Options

In this Chapter we:

- Describe the various funding sources available to startups, including bootstrapping, personal savings, loans, equity, and alternative methods such as crowdsourcing and grants.

- Explore the benefits and drawbacks of each approach, and discuss when to consider multiple funding sources for diversification.

- Offer practical advice on assessing personal resources, researching startup loans, and identifying potential investors or partners.

When it comes to getting your startup off the ground, there are different ways to secure the funds you need. You can tap into your own savings, attract investors, take out loans, rally support from the crowd through crowdfunding, or even seek out grants.

Each option has its pros and cons, and choosing the right one depends on where your startup is at and where you want to take it. It’s all about finding the funding path that suits your unique startup journey and helps turn your commercial ideas into a successful reality.

Bootstrapping

Issue | Details |

|---|---|

Description | Bootstrapping in business refers to starting a company without external help or capital. It involves funding the startup through personal finances or the operating revenues of the new company. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Bootstrapping is a popular method for funding a new business, with the majority of startups initially bootstrapped. It allows for maintaining control over the business without the need for external investors. Bootstrapping requires discipline, creativity, and ingenuity. It can be easier to get a clean capitalisation structure for future investments if the business is initially bootstrapped. Options like using business credit cards, early provision of services with reinvestment of that money in the business, and reducing costs, are strategies for successful bootstrapping. |

Risks of Bootstrapping |

|

Risk Mitigation |

|

Bootstrapping vs Private Investment

- Private Investment involves acquiring funds from external sources like family, friends, or private investors, often leading to shared financial risk and potential equity dilution.

- This method can provide more substantial initial capital, potentially accelerating business growth and scaling.

- However, it may come with the trade-off of reduced control and the risk of straining personal relationships.

- In contrast, Bootstrapping is self-funding the business. You retain full control and ownership, but this may often result in slower growth due to limited financial resources.

- Bootstrapping demands efficient use of funds and can be more challenging in attracting top talent or pursuing rapid market expansion.

Private Investment

Issue | Details |

|---|---|

Description | Private investment involves funding from private individuals or entities, often from the entrepreneur’s personal network, like family, friends, or private investors. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Private investment can bring not only funds but also the investors’ expertise and network, which can be invaluable for business growth. Think Shark Tank! It’s crucial to manage your relationship with the private investor professionally to avoid potential conflicts. The terms of investment can vary widely, and they often require careful negotiation and clear legal agreements. A massive danger here is loaning money from family and friends without a written contract signed by both parties. |

Risks |

|

Risk Mitigation |

|

Seed Funding kickstarts your startup, and Angel Investors provide crucial support. Seed Funding can offer that initial financial push, while Angel Investors often bring the experience and mentorship that a startup founder needs. These elements combined can help to fuel your startup’s growth and success.

Chapter 4: Seed Funding and Angel Investors

In Chapter 4, we:

- Define Seed Funding and its role in startup growth.

- Highlight the significance of early-stage investors, also known as Angel Investors.

- Provide insights into attracting Angel Investors and securing Seed Funding, including creating a compelling pitch deck.

Seed Funding

Issue | Details |

|---|---|

Description | Seed funding is the initial capital used to start a business, typically from angel investors, venture capitalists, or incubators, focused on market research, product development, and early operations. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Seed funding is crucial for startups to move from idea to an operational stage. It often comes from angel investors, venture capitalists, or incubators. |

Risks |

|

Risk Mitigation |

|

Seed Funding vs Angel Investment

Source of Funds

- Seed Funding: Often sourced from the entrepreneur’s personal network, incubators, or early-stage investors.

- Angel Investment: Comes from wealthy individuals looking to invest in promising startups.

Capital Amount

- Seed Funding: Generally offers smaller amounts, tailored for initial stages like product development.

- Angel Investment: Typically provides larger sums, enabling more significant business growth and development.

Equity Dilution

- Seed Funding: Usually involves less equity dilution compared to later-stage investments.

- Angel Investment: Often results in higher equity dilution as angels seek a substantial return on their investment.

Control and Decision-Making

- Seed Funding: Entrepreneurs maintain more control with minimal investor oversight.

- Angel Investment: Might require more negotiation on business decisions, with angels having a more significant say.

Risk for Investors

- Seed Funding: Lower risk due to smaller investment amounts.

- Angel Investment: Higher risk as angels typically invest larger amounts in the early stages.

Growth and Scaling

- Seed Funding: Supports initial growth but may not be sufficient for rapid scaling.

- Angel Investment: Provides a stronger financial foundation for aggressive growth and market expansion.

Investor Involvement and Support

- Seed Funding: Investors may offer mentorship but are less involved in daily operations.

- Angel Investment: Angels often bring extensive experience and networks, offering more hands-on mentorship and strategic connections.

In essence, Seed Funding is more about getting the startup off the ground with essential capital and less investor control, while Angel Investment is about injecting more substantial funds into the business for significant growth, often accompanied by greater investor involvement and equity sharing.

Angel Investment

Issue | Details |

|---|---|

Description | Angel Investors are affluent individuals who provide capital for startups, often in exchange for ownership equity or convertible debt, during early stages of a startup. Angel Investors usually support start-ups earlier on in their journey, when the risks of start-ups failing are relatively high and when most other investors are not prepared to back them. A small but increasing number of Angel Investors invest online through crowdfunding or organise themselves into groups or networks to share investment capital and increase their investment reach. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Angel investors often invest in the entrepreneur’s potential as much as the business idea.They can be a crucial source of capital, especially when other funding options are limited. |

Risks |

|

Risk Mitigation |

|

Chapter 5: Venture Capital Funding

In this Chapter we:

- Explore the realm of Venture Capital (VC) funding and its stages, such as seed, series A, B, C, and more.

- Discuss the role of venture capitalists in supporting startups and provide tips on preparing for VC pitches.

Venture Capital

Issue | Details |

|---|---|

Description | Venture Capital is financing provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential, in exchange for equity. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Venture capital is ideal for high-growth startups with a clear path to significant returns.The process of obtaining VC funding can be highly competitive and demanding. |

Risks |

|

Risk Mitigation |

|

Chapter 6: Crowdfunding for Startups

In this Chapter, we:

- Introduce crowdfunding as an alternative funding method and explain rewards-based, equity-based, and peer-to-peer lending crowdfunding.

- Provide insights into popular crowdfunding platforms and discuss the benefits and challenges of crowdfunding.

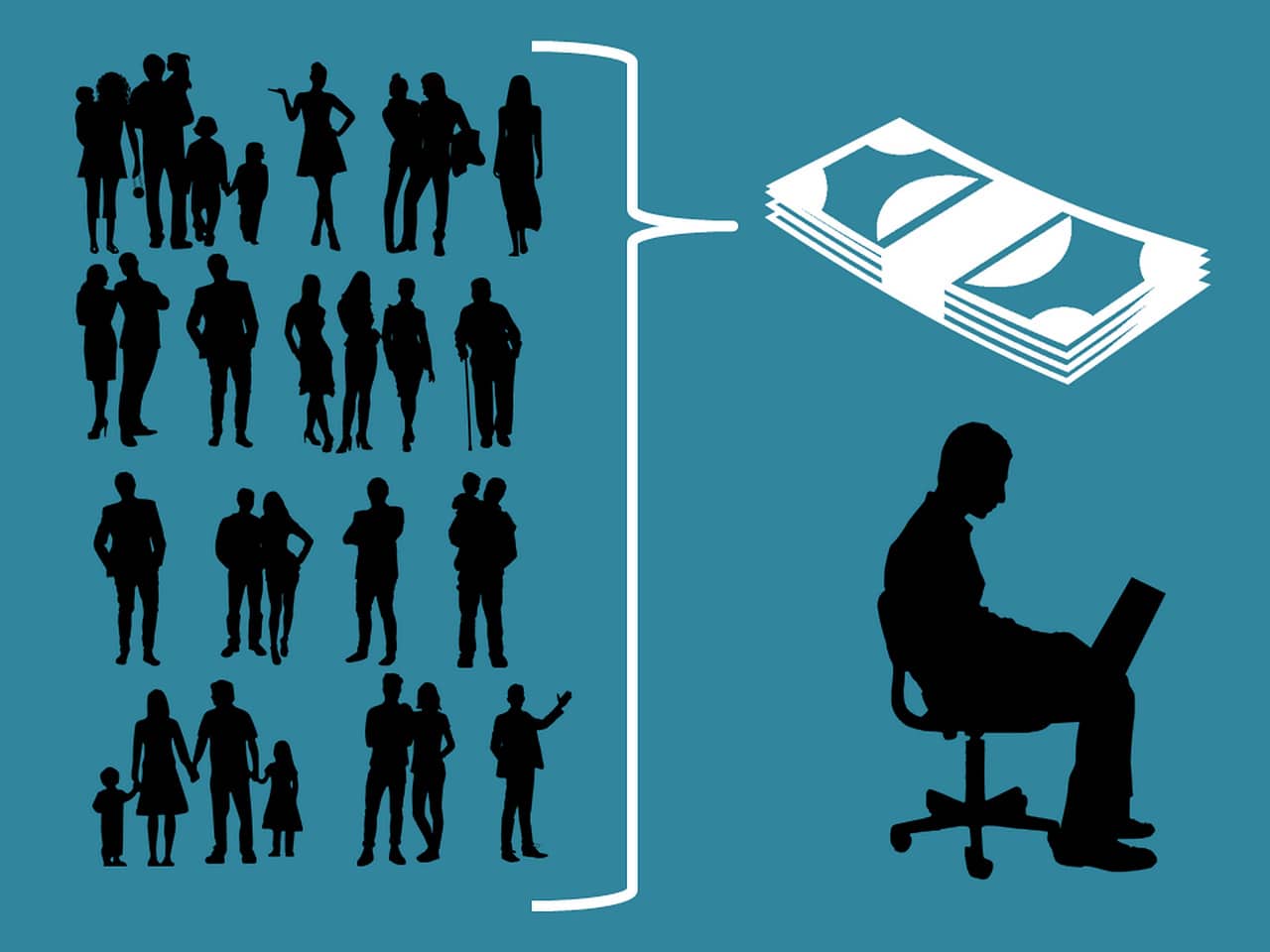

Crowdfunding is a funding method that involves raising capital by collecting small amounts of money from a large number of individuals, typically through online platforms or websites. It allows entrepreneurs, businesses, or individuals with creative projects to secure financial support from a broad audience, often referred to as “backers” or “crowdfunders.”

Crowdfunding

Issue | Details |

|---|---|

Description | Crowdfunding involves raising small amounts of money from a large number of people, typically via the internet, for a specific project or venture. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Crowdfunding is a great way to gauge market interest and build a customer base while raising funds.It requires a compelling story and effective marketing strategy – you may need to carry out multiple crowdfunding campaigns. |

Risks |

|

Risk Mitigation |

|

Chapter 7: Small Business Grants

In this Chapter, we:

- Explore the concept of small business grants, including sources like government, companies, and philanthropists.

- Discuss eligibility criteria and the impact of grants on startup growth.

- Offer practical steps for researching and crafting persuasive grant applications.

Government Grants – Small Business Grants

Issue | Details |

|---|---|

Description | Government grants are non-repayable funds provided by government bodies to startups, often for specific projects or purposes, such as research, innovation, or social impact. |

Advantages |

|

Disadvantages |

|

Suitable For |

|

Challenges |

|

Strategies for Success |

|

Examples |

|

Additional Insights | Government grants are an excellent source of funding for specific projects but require alignment with specific government objectives and compliance with strict guidelines. |

Risks |

|

Risk Mitigation |

|

Start with a compelling hook that grabs their attention and highlights the value you offer. This sets a strong foundation for the rest of your pitch and makes it more likely that your audience will stay engaged and interested throughout.

Chapter 8: Pitching for Business Funding

In this Chapter we:

- Discuss the art of pitching for startup funding and highlight key elements of a successful pitch.

- Explain how to demonstrate a well-defined plan and financials while getting investors excited yet remaining realistic.

A top tip for pitching is to clearly and succinctly articulate your value proposition early in your pitch. In the first few minutes, your audience, whether investors or lenders, should understand what problem your product or service solves, why it’s unique, and how it benefits them.

Chapter 9: Managing Startup Debt

In this Chapter we:

- Explore the role of debt in startup financing and discuss the challenges associated with managing it.

- Provide strategies for effective debt management and the importance of prioritising debt repayment.

Chapter 10: Key Takeaways

In this Chapter we:

- Summarise the key lessons from each chapter and reinforce the importance of thorough planning and research.

- Highlight the diverse funding options available to startups and emphasise the significance of effective pitching and debt management.

FAQs

We finish our Ultimate Guide with a section addressing common questions about startup funding, providing practical answers to guide your funding journey.

Conclusion

In this Ultimate Guide to Startup Funding, we’ve discussed a number of the intricacies of securing the funding that your startup needs to thrive.

From understanding the various funding sources available, learning how to craft a compelling Business Plan (and being able to use our Business Plan Template should you wish), discovering how Angel Investors and Venture Capitalists work, understanding how to harness the power of crowdfunding, learning how to apply for small business grants, and understanding efficient debt management, you’ve gained invaluable insights into the world of startup funding.

But the journey doesn’t end here. As an entrepreneur, you’ll continually adapt and refine your funding strategy, seeking new opportunities to fuel your business’s growth. Remember that your success will depend on your persistence, resilience, and understanding of the ways you can take advantage of the startup world.

Make sure you always remain committed to safe financial practices, and stay attuned to market trends and investor preferences. Cultivate relationships, seek mentorship, and embrace innovation where it makes sense to do so.

And don’t forget to bring your advisers (financial, accounting, business and legal) along the journey with you!

So embrace the challenges, celebrate your victories, and continue building your own legacy in the world of startups in a safe and sustainable manner.